Buying A Used Car

Logan is a board director for LifeChange Concepts. He's also in his mid-20s and has bought, as well as sold, over 30 vehicles. So he's uniquely qualified to share his expertise on buying a used vehicle. His wisdom is also insightful for young adults purchasing their first vehicle.

Outside of purchasing a home, buying a vehicle can be one of our most significant personal expenses. According to Kelley Blue Book, even with prices trending downward, the average sold new car costs $47,401 (1). Financially, this is unrealistic for most young adults without some form of financial assistance or loans.

Since new cars typically fall outside the budget of most young adults, many decide to purchase a used car. This option, however, can be equally financially harmful. Kelley Blue Book reports that the average advertised used car price, even with prices trending downward, remains at $25,328 (2). When consolidated to an auto loan, the average annual cost for a used vehicle is $6,384 (3).

This is a notable portion of the average income for the average young adult. The U.S. Bureau of Labor Statistics indicates that the average earnings for workers between 16 and 24 years old in 2023 were between $29,424 and $35,088 annually (4). At LifeChange Concepts, we teach people to follow the “8% rule.” If you cannot pay cash for a vehicle, you should spend no more than 8% of your net income on a car payment. For a young adult earning the average wage, their car payment should not exceed $2,354 to $2,807 annually. To compare, for someone to meet the 8% rule on the average annual used car loan, they must earn $79,800 annually.

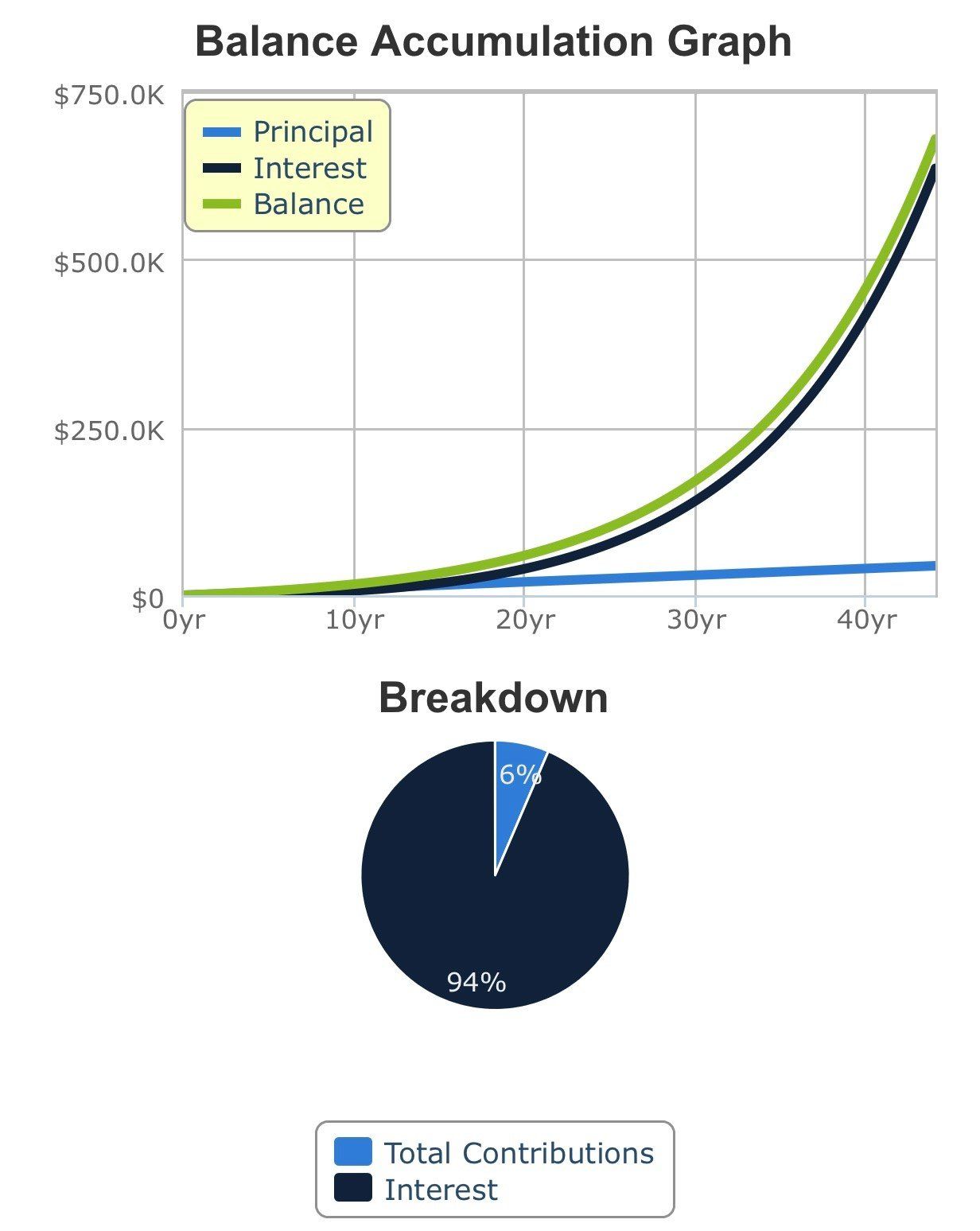

LifeChange Concepts director Bill Renje works with many young adults who spend 20-25% of their net income on their car payments. Allocating excessive amounts of income toward a car prevents you from saving for things like education, retirement, or a down payment on a house. To illustrate the long-term effect this can have, I will contrast two young adults:

Young adult one earns $30,000 annually, spends 20% of their income on a car payment, and saves 20% of their income to buy a house in five years.

Young adult two also earns $30,000 annually but saves 40% of their income to buy a house in five years.

Both young adults purchase the same house with identical terms. The house cost $300,000 with a 30-year mortgage at 7% interest.

Young adult one has saved $30,000 for the down payment (10% of the house cost). Their monthly payment is roughly $2,321. The total amount paid after 30 years is $835,560.

Young adult two has saved $60,000 for the down payment (20% of the house cost). Their monthly payment is roughly $1,998. The total amount paid after 30 years is $719,280.

Young adult one paid $116,280 more than young adult two over 30 years, all because of the car they paid for as a young adult.

To be transparent, I am not your average statistic when it comes to vehicles. At 23 years old, I have never purchased a new vehicle. I have purchased almost 20 used vehicles since I was 17, most of them being sold for a profit or parted out within my business. I have never paid more than $5,000 for any personal vehicle, including my two current daily drivers. My dad is a master mechanic and aircraft technician who taught me how to work on vehicles and diagnose common issues.

However, I do not believe you must be a master mechanic or a financial expert to make sound decisions when purchasing a used vehicle. The below-outlined steps do not guarantee that you will quickly find an affordable, reliable vehicle, but I believe they will increase the likelihood.

1. Know the Difference Between Your Needs and Wants

This is the first and simplest step in searching for a car. You need to know what your needs are. How many people do you need to fit in your car? How important is safety to you? Does your vehicle need to fulfill any additional needs beyond commuting? Do you need a truck, sedan, or minivan? For example, when I began searching for my last vehicle, I knew I needed a truck to haul things for my business.

You also need to know what your preferences are in a vehicle. For example, I preferred a truck larger than a single cab for additional dry storage and to drive multiple people. I also preferred a truck with good gas mileage because I knew I would potentially be driving large distances. Maybe you dream of cruising down the street settled into burgundy-red Cadillac couch seats. Maybe you want to convert a hearse and refilm Ghostbusters. Maybe you want to don the shades and import a Supra to live Fast and Furious.

Joking aside, I believe there is a difference between financially beneficial and unbeneficial preferences. I might prefer luxurious heated leather seats and a premium sound system, but these are not necessary needs or preferences, especially when searching for a first or an affordable used car.

2. Search Criteria

Once you identify your vehicle needs, I believe the primary factor to consider is vehicle dependability and reliability. There are different organizations with differing opinions concerning vehicle reliability. One example, Consumer Reports, reported that Lexus, Toyota, Mini, Acura, and Honda were the highest predicted reliable brands, while Chrysler, Mercedes-Benz, Rivian, Volkswagen, and Jeep were the lowest (5).

You should combine your vehicle needs with researched predicted reliability. From my experience, most people have a personal brand preference, but these are often just that: preference. Even if I love Chrysler, if they are at the bottom of researched predicated reliability of all current automakers, I should reevaluate my commitment to that brand. Your needs paired with reliability are more important than brand loyalty.

Once you narrow your search to a particular vehicle (or several), research common problems associated with those vehicles. For example, during my Tacoma research, I found they are prone to front lower ball joint failure. If I purchased a Tacoma, and the previous owner had not already replaced these parts, I would need to potentially replace them, which I did in this exact scenario.

3. Begin the Search

Once you have identified your needs, researched reliability or other criteria important to you, and have narrowed down to a particular vehicle, you can search for an actual car. The below-outlined steps have served me well when searching for a reliable, affordable used vehicle.

If possible, stay away from dealers. This includes name-brand dealerships, local used dealerships, and individual licensed dealers or car flippers. As someone who sells cars and car parts for a living, my experience is that some dealers focus on the largest, quickest, most profitable vehicle turnover, not selling affordable, reliable vehicles. Though a dealer will often be the easiest and quickest option, they might not be the most affordable or reliable.

Look for private party individual sellers. There are many methods for locating private sellers, including word of mouth and social media posts, but the most beneficial for me have been Craigslist and Facebook Marketplace. Craigslist has declined over the years, but I found my current Tacoma on Craigslist in 2022. Facebook Marketplace might be a better consistent option. When responding to an online ad, ensure that you are dealing with a real person and not a scammer. Watch out for newly created social media profiles, blurry pictures, identical listings from the same profile, or requests for any personal information.

Once you have chosen a method, begin searching for a vehicle. For example, within my budget, I was regularly looking at 1st generation 1995-2004 Tacoma trucks. I advise checking every day when you are seriously looking and ready to purchase a vehicle. From my experience, most used vehicles on Facebook Marketplace sell within several days of being listed. If they do not sell quickly, it could mean the car is priced too high or something is wrong it.

There are several ways of determining the fair value of a used vehicle. Kelley Blue Book offers a free “My Car’s Value” tool on their website. Once you input basic information, such as the make, model, mileage, and condition, they indicate the private party value range for the vehicle. An additional method is to observe the values of cars through online sites like Facebook Marketplace. For example, the KBB value for my Tacoma was notably lower than the listed price when I purchased it in 2022. However, after months of searching, I had a difficult time finding anything reliable closer to the book value. Even though my truck cost more than the book value, the market at the time was driving demand and prices higher. Book and market value should be considered together.

Once you locate a specific vehicle, there are several imperative criteria to evaluate:

Make sure the car has a clean title in the seller’s name. Stay away from any vehicle with a salvage or rebuilt title. This means the vehicle was physically or mechanically totaled by insurance and then repaired. They are worth less than a clean title vehicle and could potentially have significant, often hidden, body and mechanical issues. For the same reasons, avoid vehicles that have been repainted and/or in known accidents. Sellers might not disclose these. Running a Carfax can help with this and other vehicle history but does not always indicate everything.

Make sure the car is not stolen. The National Insurance Crime Bureau offers a free VIN check tool on its website for stolen or salvage vehicles.

Make sure you can pay cash. Private-party sellers will not accept major credit cards, auto loans, an IOU, or indentured servanthood. Ensure the car reflects your cash budget. Right now, many reliable used cars can be found in the $5,000-10,000 range, sometimes even less.

4. Looking At a Vehicle

Once you’ve found a researched vehicle that will meet your needs within the fair market value range, you can evaluate purchasing the vehicle. I will list several criteria that I watch for when looking at a car. Some of these things are noticeable in the listing description and pictures, while others must be seen in person or asked of the seller. I would strongly advise having a mechanic or mechanically inclined person to inspect the car with you. Here are some things to ask or watch for:

- How long has the seller owned the car? Do they have maintenance records? Why are they selling it? If something seems positive or negative about the seller, their story, or their reasons, it must be factored in your purchase.

- Does the car have any physical damage on the exterior or interior? Can you tell if the seller has taken care of the car or neglected it? Does the car have any indication of being in an accident, such as disproportionate body panels or being repainted? Does it need anything replaced? These detract from the value, desirability, and in some cases, reliability, and safety.

- Has the car passed emissions? Emissions requirements vary from county to county. Ensure that the vehicle will meet your county requirements or be prepared to potentially repair emissions equipment.

- Does the car have high mileage? Some cars can reliably run for well over 200,000 miles, like my Tacoma, which currently has over 250,000. It is ideal to look for a car with 150,000 miles or less or be prepared for more mechanical repairs.

- Inspect the bottom of the vehicle and the frame. Check for any rust. Cars from certain areas of the United States are notorious for rust. This can affect value, desirability, and most importantly, in some cases, reliability and safety.

- Inspect the engine oil, transmission fluid, brake and power steering fluid, and radiator coolant. Are all the fluids properly filled to the required amount? Are any fluids miscolored/dark, low, or missing from the dipsticks? Does the coolant in the radiator have any rust or contamination? These can indicate improper vehicle maintenance and potential mechanical wear or damage.

- Inspect the tires and brakes. How much tread do the tires have left? When were the brakes last serviced? Does the A/C, heater, mirrors, windows, and radio work? Items like these factor into your total potential vehicle cost.

- Some vehicle engines have a timing belt, while others have a timing chain. Look up the engine type of your car to see if it has a belt or chain.

Timing belts typically have a service lifetime of around 100k miles. Depending on the engine, if they are not replaced and break, they can cause significant damage. If the previous owner does not have record of replacement or it is close to the required service interval, that is a significant maintenance expense to consider.

Timing chains can go bad, but typically last much longer than a timing belt and do not instantly break. My Tacoma, for example, currently has over 255k miles on the original timing chain.

- Take the car on a test drive. How does it sound and drive? Does it have any abnormal noises or shaking? Does it accelerate and brake normally? Does the transmission shift between gears smoothly?

This list is not comprehensive but should provide a foundation for looking at a used car. If the car fails some of these criteria, such as needing new tires or brakes, do not automatically walk away, but factor how much work and money you want to put into the car. Be willing to negotiate with the seller. Make a cash offer that reflects the fair market value minus any known issues with the car. However, if the car has bad rust, the tires are bald, and there’s a loud knocking coming from the engine, you should walk away.

5. To Buy or Not to Buy?

If the car meets most of the criteria, and the negotiated price fairly reflects condition and suspected reliability, you can consider buying it. If the car fails essential criteria or is notably more expensive than the book and market value and the seller refuses to negotiate, be willing to walk away. I have walked away from more vehicles than I have bought for myself. I looked at hundreds of cars online and inspected roughly half a dozen in person before I purchased my Tacoma. Do not become emotionally attached to any vehicle before you buy it. It can be frustrating and annoying, but it is better to walk away from a bad deal than be stuck with a bad car and need major repairs, or even worse, another car.

Resources:

https://www.kbb.com/whats-my-car-worth/

https://www.carfax.com/vehicle-history-reports/

https://www.nicb.org/vincheck

References:

1. “Average New Car Price Tumbling,” Kelley Blue Book, February 13, 2024, https://www.kbb.com/car-news/average-new-car-price-tumbling/.

2. “Average Used Car Price Down 4% Since Last Year,” Kelley Blue Book, February 19, 2024, https://www.kbb.com/car-news/averaged-used-car-price-down-4-since-last-year/.

3. “Average Car Payment and Auto Loan Statistics 2024,” LendingTree, March 7, 2024, https://www.lendingtree.com/auto/debt-statistics/.

4. “Labor Force Statistics from the Current Population Survey,” U.S. Bureau of Labor Statistics, https://www.bls.gov/cps/earnings.htm#demographics.

5. “Who Makes the Most Reliable New Cars?,” Consumer Reports, November 29, 2023, https://www.consumerreports.org/cars/car-reliability-owner-satisfaction/who-makes-the-most-reliable-cars-a7824554938/.