How To Replenish Lost Savings

What Should I Do After Exhausting My Savings?

Imagine you're working hard one day and the next you are out of work. Years of hard work learning and growing your team's belief and trust in you goes out the window. The nightmare of no income and bills increase your heart rate and blood pressure.

Then all the sudden relief comes over you, knowing you prepared for this. You smartly put money aside in stocks and savings accounts just for emergencies. A few months later the opportunity comes to go back to work, and a new fear comes to reality. How do you replenish all the savings used to pay bills and feed you during this unemployment period?

Here are some tips on how to gameplan to grow your emergency fund:

1. Don't try to recover lost funds:

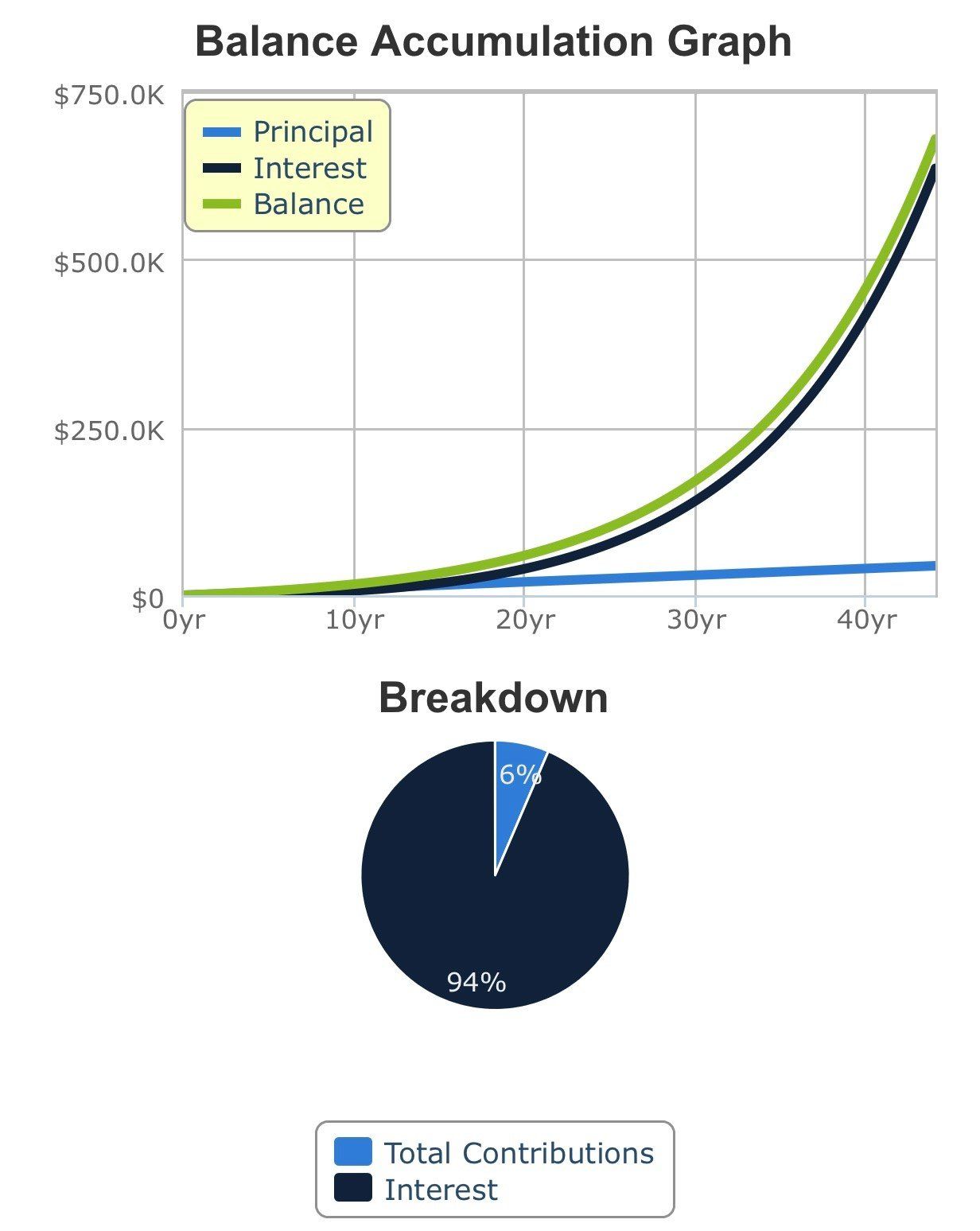

Our Board President Jeremy Burton recently went through this exact scenario, and one of the things he tried was making up the lost funds and building up his savings. Make your game plan like you're starting off brand new, when trying to replenish and make up lost funds you will quickly find that you're not setting one goal but two. This will create stress when it comes to creating a new budget from your new income. As a young adult, the compound interest that you get in 20-30 years will replenish all the savings you lost during your unemployment. “Compound interest and compounding can supercharge your savings and retirement potential. Successful compounding lets you use less of your own money to reach your goals.” (1)

Ultimately, no matter if you had to use your emergency funds or not, your compound interest is what will build your retirement wealth, not your investment.

2. Create new Goals:

Another lesson Jeremy learned from this season is that he had to create new goals that aligned with the setback. A lot of Jeremy’s investing was going to be his home down payment. After several years of growing and adjusting he could simply not go back to the plan he had before being unemployed. In essence, he started back at ground zero and will work his way up. Even though the goal is the same, the market is always changing. So instead of using foundational stocks like caps and dividends, he plans to benefit from the interest rate and keep the money for the down payment of his home in the more conservative, and less volatile, money market.

3. Start small:

When it comes to the amount and how often you invest, take the first couple months slow. Whether your income changes or not, it is essential to take the first few weeks to create a new budget. Once again Jeremy learned a valuable lesson when he found himself needing money for gas and being a few days away from payday. Even though he had an increase in pay he did not correctly allow time to see the pattern of his new paycheck and assigned more money to different places in his life then he had. Quoting Jeremy ; “It is never fun when a twenty - eight year old has to go to his dad and ask for gas money to get to his new job.” It's ok to start with a few dollars here and there for a few weeks and then start putting in a few hundred dollars to invest.

4. RELAX:

At the end of the day, the biggest thing Jeremy realized is that he is still young even if his back and knees yell at him every day. He still has a lot of raises, time, and promotions coming that will allow him to not stress and be able to rest in God that the funds will be there when he retires or needs it. It may not be the amount he wished for, but it will be enough for him to be a steward of God's money entrusted to him. The world tells us that we need to chase this wealth for things that don't matter. We know God is in control and he will provide for not only Jeremy but you in time of need. Does that mean we don't properly invest and poorly use it, of course not. But we invest knowing that whatever comes of it will be for the Glory of God. We give praise to him that we have an emergency fund when we are unemployed, when we are able to use our investments to send a kid to camp or pay for someone to go serve on a mission trip. We praise him when using it to continue to allow the gospel to grow and be presented to those whose hearts are hardened to God’s unending love.

And never forget while resting easy that,

“The Lord is my shepherd; I shall not want. He makes me lie down in green pastures. He leads me beside still waters. He restores my soul. He leads me in paths of righteousness for his name’s sake. Even though I walk through the valley of the shadow of death I will fear no evil, for you are with me; your rod and your staff, they comfort me. You prepare a table before me in the presence of my enemies; you anoint my head with oil; my cup overflows. Surely goodness and mercy shall follow me all the days of my life,and I shall dwell in the house of the Lord forever.” Psalm 23

Even though you feel like if you don't recover the lost funds you will be in the shadow of death in your later years, God promises us that no matter what we are in fact presently and forever be by still water and we can rest in the green grass as you start a new journey in your investing, just like you are in your career.

1.Curry , Benjamin. “The Life-Changing Magic of Compound Interest.” Edited by Kate Ashford, Forbes, Forbes Magazine, 20 June 2024, www.forbes.com/advisor/investing/compound-interest/.