Top Financial Mistakes Made By Young Adults

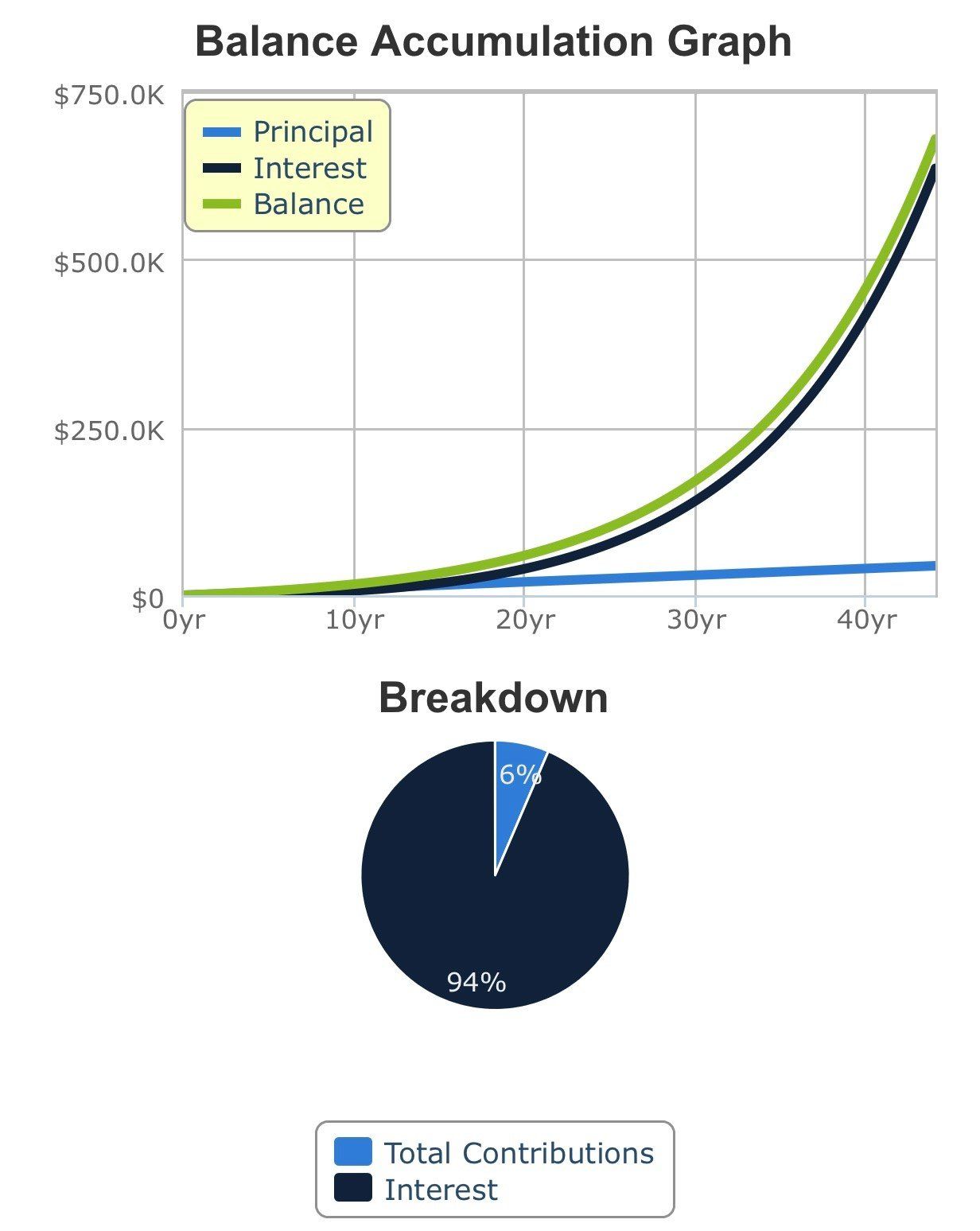

“Overly spending on leisure and entertainment is a problem with almost all my friends. There is also a mindset of not preparing for the future or thinking ahead but living in the moment. Talking about saving money, let alone retirement money, is like pulling teeth with some of my peers. It takes a big picture perspective to understand that every $1 saved and invested at 20 years old equals around $88 at retirement.” – Logan, LCC Board Director of Young Adult Discipleship & Mentoring.

My favorite subject is history because I believe, as it's been said, that if you want to know where you are going, you have to know where you've been. From a financial perspective, what we've been is a consumption-based culture, relying on debt since the 1980s. But it's important to understand, which is why I cover it in classes I teach, that we weren't always a consumption-based culture.

Prior to the 1980s, we were a production-based culture, which means that our value came from what we produced, what we added to the culture around us through our labor. I'm old enough to remember the 1970s where work ethic, thrift, savings, delayed gratification were still values and concepts that were taught and lived out. But that’s all gone now.

Today, we have a generation of young adults, who've known nothing but growing up in a consumption-based society that's told them that their value comes, not from what they’ve worked for and produced, but what they buy and consume. It's been great for Wall Street, for the wealth creators and generators, the powers that be and the big banks. But not so great for Main Street where the cultural messaging has taken root that fulfillment in life comes through consumption of entertainment, leisure and products.

This may sound controversial to some, but the current social-economic climate in the West, particularly the US, is at its root anti-Gospel (in my opinion). The consumption-fueled mentality is based around self-pleasing, self-centered, instantly gratifying behavior, disregarding the role of wise financial stewardship, let alone Gospel-centered financial stewardship. I do not believe that is what Christ desires from or for His people.

According to the young adults on our board, here are 10 main mistakes young adults make:

1. Spending over half their earnings on eating out or hanging with friends.

2. Racking up credit card debt due to poorly budgeting strategies.

According to Experian “The average credit card balance among consumers in their 20s was $2,709 in Q2 2019. Credit card debt increased the most among 20-year-olds year over year….” (1). Even though this article is from 2019, we can only expect the numbers to increase as we study the trends of spending habits.

One good recent example our team came upon was with a student in one of our classes. After going through the course and learning the foundations of a budget, he noticed that 60% of his earnings were being thrown down the drain while constantly eating out with friends. As we told him, we don't discourage hanging out with your friends. But we do encourage limiting how much you spend, while budgeting the number of events and amount you can spend per week , paycheck, or month.

The next four mistakes can seem little at the moment, but overtime can have young adults paying thousands of dollars extra in loan interest.

3. Buying cars, typically newer with high interest and high monthly payments.

4. Not paying extra on bills while they are single (extra money on student loans)

5. Relying too much on student loans (as a ministry, we’ve seen college students take out loans in excess $75,000 for

low-paying degrees.)

6. Renting vs living with parents

Jeremy, our board president, can speak from experience in regard to this section of mistakes. Luckily, in his case, he will enjoy the prospering fruits in the coming years of not making some of these mistakes, unlike a lot of young adults his age. Though Jeremy decided to go out of state and leave the opportunity of the HOPE Grant. He did take advantage of the online program at Liberty University , graduated with a four-year degree and with the help of grants left school with less than $30,000 in debt.

Jeremy also pays $100 extra month on top of his monthly consolidated loan payment, which he is able to do since he still lives with his family and has limited bills. He’s on track to pay off the loan early, which will save him anywhere between $2,000- $3,000 in interest that he will see later on in the loan cycle.

Lastly, these mistakes will hinder young adults in the future.

7. Not setting up a retirement account

8. Not caring about credit score

9. Not setting up a savings account in case of an emergency fund

10. Not using a financial advisor

A young adult's mind is full of life, ideas, and adventure; but also can be full of short sightedness and lacks the wisdom of experience. This is the time every 50-year-old would love to go back to and change one or two small things in their life to make their life a little easier with their retirement or savings account.

The introduction of a financial advisor in your young adult life will bring not only discipline into their budgeting and spending. But it will also develop an easier time for them when they are older and can truly appreciate their hard work in saving up for retirement and those pesky emergencies.

“You can’t predict the future, but you can prepare for it. A financial advisor can help you cope with the fallout of life's unexpected events and adapt your strategy to stay on track.”(2)

While it’s impossible to put the ketchup back in the bottle, we can teach, and more importantly model, as Christians that our identity comes from our God who created us. And that God-given value comes from and through our work, our giving of our time and money and our service to the culture and world around us.

We can also teach good, solid biblical financial stewardship principles to a largely financially illiterate society and culture around us. Whether its grandparents, parents or young adults, the mission of our LifeChange Concepts ministry is to wed both biblical financial stewardship principles, and practical financial literacy tools to free young adults to live out the plan, the purpose and the ultimate mission that the Lord has for them.

Feel free to contact us if you need help addressing any of the top ten financial mistakes listed above!

1. Tatham, Matt. “Americans in Their 50s Have the Highest Average Credit Card Debt.” Experian, Experian, 5 Nov. 2019, www.experian.com/blogs/ask-experian/research/credit-card-debt-by-age/#s1.

2. Sabharwal, Sanchit. “Benefits of Working with a Financial Advisor - New (US: En).” Edward Jones, Edward Jones, www.edwardjones.com/us-en/working-financial-advisor/benefits-working-financial-advisor. Accessed 14 Feb. 2024.